December 21st, 2011 — baltimore, business, design, economics, geography, trends

There’s been an explosion of interest in new “startup accelerators,” incubation, coworking, startup funding, and new-manufacturing efforts in Baltimore in the last few months; unfortunately this appears to say less about Baltimore than it does about the growth in interest in these efforts worldwide.

Here’s a list of some efforts in this space:

- “Accelerate Baltimore” at ETC Baltimore

- Accelerator led by Cangialosi and Lane

- ETC Baltimore itself (Canton and 33rd street)

- Baltimore Node, Hackerspace on North Avenue

- Sizeable Spaces, coworking in South Baltimore

- Capital Studios, coworking on Central Avenue

- Beehive Baltimore, coworking at ETC Baltimore

- Accelerator effort being driven by Mike Brenner

- Accelerator/cyber/techspace in Harbor East, led by Karl Gumtow

- Innovation Alliance effort being led by Newt Fowler

- Theater/workspace being discussed by Chris Ashworth/Figure 53

- Shared warehouse workspace being discussed by Andy Mangold/Friends of the Web

- Baltimore Angels (Cangialosi et al)

- Invest Maryland fund (DBED)

- TEDCO’s Innovation fund

- Abell Foundation fund (tied to Accelerate Baltimore)

- Wasabi Ventures fund (investing in city, affiliated with Loyola)

- Fabrication Lab at Towson University

- Fabrication Lab at CCBC

- Fab-lab ideas discussed by John Cutonilli

- Highlandtown workspace development led by Ben Walsh

- Mike Galiazzo, pushing Local-Made, (head, Regional Manufacturing Institute)

Did you know about all of these things? Amazingly, many of the people leading these efforts don’t. Or if they do, they’ve not actually talked to the people involved. To me, this is a problem.

Why? Because folks attempting to gather support for these efforts don’t have all the facts. They either haven’t sat down and listened to people’s motivations, and they’re flying blind. Or it means that they have been unable to sell other like-minded entrepreneurs on their vision, which probably means their vision is not that compelling. And that’s even worse.

But this is not all that’s wrong.

Two Serious Problems

One: there’s a tremendous amount of duplication of effort represented in the list above. Why duplicate all of that administrative, accounting, legal, and governance overhead? By pooling more of these efforts together, that overhead can be minimized and shared.

Two: we don’t have enough human capital to support all of these different efforts. We simply DON’T. Many seem to think it will somehow materialize, but from where I sit, with possibly the widest-angle view of the landscape here of anyone, I don’t see that flow of new startups or even new individuals that can support all of this. It just doesn’t exist.

The Opportunity

Baltimore has an opportunity to become a regional and even international destination for people looking to start or join entrepreneurial enterprises. But for that to happen, we need to have stuff here that can actually become a destination.

And unfortunately, the efforts currently underway are not likely to become that destination because duplicated overhead will keep each effort small and parochial.

However, if more of these efforts pooled their resources and talent – and most importantly identified a BIGGER and more IMPORTANT vision for what it is they are trying to achieve, there would be many positive effects, such as ample governmental and foundation support. And that would be hugely helpful in funneling in the sorely lacking regional and international *human capital* that we so desperately need here!

One Possible Vision

Baltimore has an opportunity to become the hub for digital manufacturing and mass-customization technology on the east coast.

Cangialosi and Lane are already talking about supporting some basic fabrication capabilities at their proposed facility on Key Highway. Gumtow’s effort has placed fab-lab capabilities high on its priorities list. CCBC and Towson have fab-labs, though it’s my understanding they may be underutilized. If you’re going to spend money on fabrication equipment at all, it should be utilized 24×7 in order to maximize the asset.

Something bigger – like taking over the WalMart in Port Covington, or the Meyer Seed Warehouse in Harbor East – could support an accelerator, fab lab, and shared workspace. Thinking a little bit bigger would also have the effect of lowering per-square-foot costs dramatically, and even dramatically altering the real-estate ownership structure.

Baltimore is already home to Under Armour, and at some point in the near future (similar to what happened with Ad.com) it will start throwing off new entrepreneurs with experience in consumer products and manufacturing. Where will they go? Will we keep them here in Baltimore?

Focusing on the intersection of manufacturing and technology is important because it represents the one shot we have at rebuilding even a little bit of a middle class here in Baltimore. Because of that, you’ll find abundant support for such efforts — support that can further reinforce Baltimore’s reputation as an international destination for digital and manufacturing.

The More the Merrier?

I am a fan of placing many, diverse bets rather than making a few large ones. But it’s also important to make strong bets. Unfortunately, Baltimore is right now setting itself up to have many weak positions instead of a smaller number of stronger ones.

I strongly urge the folks leading these efforts to get to know each other and coalesce around a bigger unifying vision that can turn Baltimore into an important regional and international destination for entrepreneurs.

Because without agreeing on a bigger vision, it’s likely that these efforts – each led by well-meaning individuals but with individual motivations – won’t ultimately amount to much, and it would be a shame to waste so much time, effort, and talent.

Thanks to Brian LeGette for his collaboration on some of the ideas underlying this post. Also, everyone on this list is a friend: happy to make introductions and advance the conversation.

December 14th, 2011 — baltimore, business, design, economics

It can be difficult to see the forest for the trees when it comes to defining what it is we in the so-called “tech community” are trying to achieve.

The confusion begins with names: some call it the “startup community,” the “tech business community,” or #BmoreTech. Whatever. I’ve been splitting these hairs for several years now, and with the help of many others and after many personal experiences with organizing groups, events, venues, and businesses have developed a simple but powerful vision for the community.

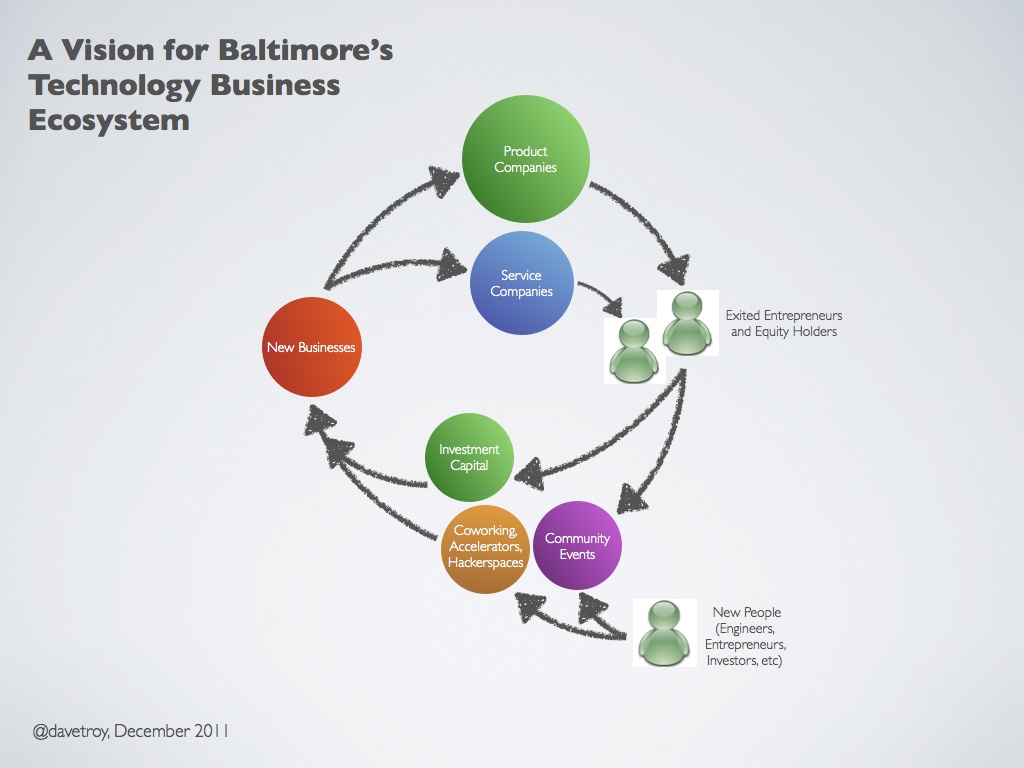

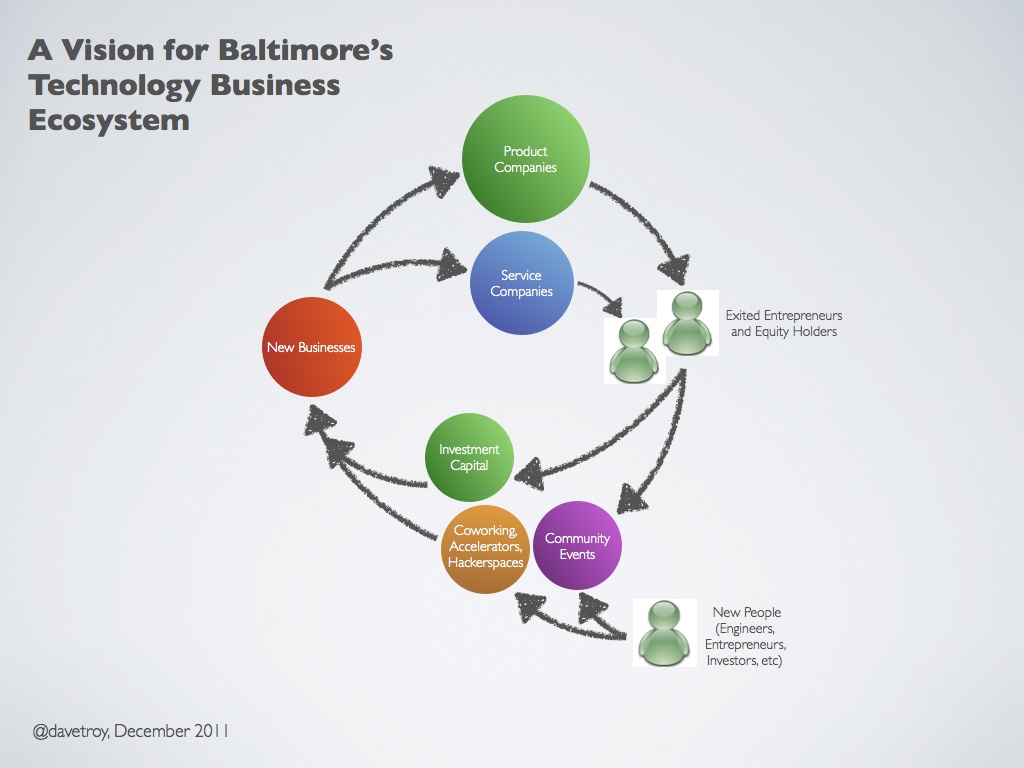

We’re all trying to build an ecosystem that looks something like this (click to enlarge):

Before we get into the specifics of this vision, here are a few basic values that underly it:

- People are the lifeblood of the community. The ecosystem requires educated, creative people. We should strive to enrich and build compelling opportunities for the people in our community.

- Businesses generate the wealth that powers our community. Strong businesses make a strong community. We should aim to make our businesses stronger and more valuable.

- There is a role for everyone. Diversity of expertise and background is essential to a strong business community. We should aspire to have a healthy mix of product companies, service companies, business service providers, and many types of venues and events for relationship building.

- We should celebrate our successes. Celebrating successes, whether they are successful exits or just milestones, is essential to creating a community that values growth, curiosity, and experimentation.

- We should connect people together. Trust and strong relationships are a precursor to new business formation. With strong trust relationships, we’ll have more new businesses and they will be more successful.

With this in mind, here’s how this model works, step by step. It’s a cycle, and for simplicity, we’ll start at the bottom.

- Getting into the mix. (6 o’clock) New participants, exited entrepreneurs, investors, hackers, new entrepreneurs come together via a mix of venues and events. By “venues” I am talking about spaces that offer opportunities for daily, ongoing interaction between individuals. They’re “high touch” while being “low risk.” Think coworking, hackerspaces, regular café coworking, incubators and accelerators, and educational institutions. By “events” I’m talking about one-off or periodic events that afford people an opportunity to get together, get to know one another, and try new things. (Think Bmore On Rails, Startup Weekend, EduHackDay, CreateBaltimore, etc.) New investors can participate in angel groups and pitch events.

- New business formation, access to capital. (9 o’clock) With trust, exposure, and experience, new businesses can form. With the prolonged exposure made possible by the “mix” phase, entrepreneurs can make more informed decisions about who to go into business with and have likely had more time to refine their ideas before ever beginning. This means a lower failure rate for new startups than in a less-developed ecosystem. As for investment capital, some will come from exited entrepreneurs, some from venture capitalists, seed funds, and governmental initiatives like TEDCO and InvestMaryland. We should aim to connect investors with nascent businesses. This will happen naturally to some extent in the “mix” phase, but we should consciously encourage it; bootstrapping should also be an option.

- Business growth. (12 o’clock) Some companies will grow to become strong product companies, others will become service companies. Some people want to grow their businesses to sell them, while others just want to build and run a great business. These approaches are all valid. We should celebrate the formation and growth of all of the companies in our ecosystem.

- Entrepreneur exits. (3 o’clock) Some entrepreneurs will seek the opportunity to exit their businesses and capitalize on their growth. This is most lucrative with product companies. When these exits occur, we should celebrate them as successes of the community as a whole.

- Entrepreneur returns to the mix. (6 o’clock) Exited entrepreneurs should be encouraged to re-engage with the community, either as investors or as active entrepreneurs to form new relationships and new businesses. The cycle starts anew.

That’s really it. If we can make this cycle work, we’ll have a thriving entrepreneurial ecosystem in Baltimore. (This is the exact same cycle that made Silicon Valley great, and is now working in places like Boston, Austin, and New York.)

That’s Great, But Where Do We Stand Now?

We have much of what we need in place: venues, events, investors, and businesses. But the two things we have most lacked are a cohesive vision for how this cycle is supposed to work, and also the last link in the cycle – systematically re-engaging entrepreneurs into the ecosystem.

However, just today came the news that Greg Cangialosi and Sean Lane are forming a startup accelerator in Federal Hill. That’s an example of two successful entrepreneurs getting back into the mix and re-engaging. We need more of that. But we need to make it easier and more attractive for entrepreneurs – there need to be obvious on-ramps and channels. We’re starting to get that in place.

My hope is that this vision, which I have shared in one-on-one conversations with many friends and leaders to much enthusiastic agreement, can now take root as the underlying force that animates our community.

Role of the Greater Baltimore Technology Council

There’s been much discussion about what the role of the Greater Baltimore Technology Council should be, and I submit that this vision, as I’ve articulated it here, is what the group has been moving toward for the last three years – and with Jason Hardebeck (who is himself an exited entrepreneur) at the helm, I believe we can move towards it more quickly now.

The GBTC’s job is to:

- Help build and protect the ecosystem. GBTC should be a watchdog that ensures the ecosystem has the right pieces in place and that they have what they need to function properly. This means working with government, educational institutions, and others to ensure that the conditions required for the ecosystem to thrive are present.

- Accelerate the cycle. The faster this ecosystem operates, the more successful we will be. Specifically, GBTC should connect people together, and celebrate our collective achievements, and help pull our educational institutions into the ecosystem. Ultimately this will pull in more smart, creative people, accelerating the cycle further.

- Make our businesses stronger. By connecting our community together better and providing venues, events, connections, and celebrating our success stories, GBTC can help to make each of our businesses stronger and more robust. This also means connecting businesses to service providers (HR, insurance, accounting, legal) and mentors who can provide value.

For all the drama and hand-wringing, it really is this simple!

Some have wondered whether they “belong” in the GBTC. That’s something every person and entrepreneur has to decide for themselves; there are obviously many valid and valuable ways to participate in this overall vision that are outside of the scope of the GBTC. However, if you care about growing and protecting this ecosystem, and if the group can help your business grow and succeed, I’d encourage you to lend GBTC your support; it just makes good business sense, as GBTC is the only group that has been tasked with this important work.

I know that others in positions of leadership in Baltimore’s tech business community (and at GBTC) share this vision. I encourage your comments and feedback, but before reacting, you might take some time to really think this over. This is something I’ve been looking at for several years, and based on everything I know, this is the right way forward.

The Rest of the Story

Oh, and there’s one more thing.

We all want to prime this pump and get this vision more fully underway, but I also think it’s reasonable to ask how Baltimore’s tech ecosystem fits into the bigger scheme of things. What relationship should we have with other ecosystems, in our region and around the world? Is the point to win or are we trying to thrive? I’ll be touching on this topic in an upcoming post, and it should help to clarify how this vision makes even more sense for Baltimore.

December 13th, 2011 — baltimore, business

It’s been a busy few days in the Baltimore tech scene, sparked by the recent changes in leadership at the Greater Baltimore Technology Council. While I have been on the board since 2004, because I was away on travel the last two weeks, I did not directly participate in the decisionmaking process that led to the most recent changes. In fact, I’ve been largely consumed with building my new business (410Labs) for the last year and I’ve not had time to participate in GBTC as much as I’d like.

However, there’s been a lot of speculation about the motivations and thinking behind the change, and as I’ve at least been a part of the ongoing conversations that led up to it, I feel compelled to speak up to set the record straight.

Here’s a brief recap of the facts.

- 1999-2007: GBTC was setup as a standalone organization and was extraordinarily effective at rallying the community, building new programming, and creating connections, under the leadership of Penny Lewandowski and Steve Kozak.

- 2006-2007: The GBTC began a long term strategic assessment process, focused on modernizing the group’s technology systems (databases) and also providing value to both small and large businesses. Several recommendations were made with a goal of “building the innovation ecosystem” in Baltimore. I participated in this “strategic planning committee” at that time.

- 2008-2009: Community-developed events like Ignite, Barcamp, SocialDevCamp and others had begun to cause many to question GBTC’s role: was it for networking events, or educational events? Was it focused on small businesses, or big ones? How would it be funded? What was the membership model? The Strategic Planning Committee grappled with many of these questions.

- January 2009: the board formed a “Strategic Advisory Committee” co-chaired by me and Rick Geritz, another local tech entrepreneur. We conducted a series of interviews and surveys to help understand perceptions and best potential roles for GBTC going forward.

- May 2009: We prepared a set of recommendations and submitted them to the board. The recommendations included the idea that the group should, in addition to focusing on the needs of larger companies, also focus on cultivating entrepreneurs and driving entrepreneurship in the region. The board approved our recommendations and authorized Steve Kozak to move forward with implementing them.

- June 2009 – June 2010: Kozak and the board engaged in a process geared around making the changes we recommended. (The changes would, in fact, ultimately be quite sweeping and could not be implemented overnight.) As part of that process, several additional ideas and models were explored.

- June 2010: Ultimately, the board came to feel that Steve Kozak was not the right person to implement these changes, and sought to go in a different direction with leadership. This is not a ding on Steve; he’s a strong and talented leader who did much good for the organization. But the board felt that it was time to make a change in order to more quickly implement its strategic plan, a move which by that time had gained some urgency.

- June-December 2010: Jennifer Gunner acted as interim Executive Director, and did a strong job of moving the group in the direction outlined by the board. However, the board felt that it should perform due diligence in performing a search for a new executive director – a process in which Gunner would also be considered as a candidate. The board authorized a Search Committee to review candidates and select a new executive director. (I did not participate in that committtee.)

- December 2010: After reviewing all of the candidates, the Search Committee recommended that the board hire Sharon Webb as CEO, and appoint Gunner as Chief Operating Officer. Webb would be tasked with implementing the strategies outlined as part of the strategic assessment conducted in 2009-2010 and would accordingly have full authority to hire, fire, and make tactical changes, as required.

- 2011: Webb got up to speed with the organization and interviewed many members and partner organizations to get a feel for how to best proceed. She did an admirable job, and has a strong background in leadership and strategic change. However, as an outsider to the tech community, some wondered if she was the right person to lead the group. Changes in leadership led to many staff departures, including Gunner. This is understandable and not a reflection of anything Sharon did wrong. On the whole, the group had made some bold moves and was moving in the right general direction.

- December 2011: Jason Hardebeck, who in 2001 had founded WhoGlue, one of the first social networking companies, just completed the sale of his company’s assets to Facebook. Hardebeck has long-time ties with GBTC and has known several board members (including myself) for over 10 years. As an energetic, experienced entrepreneur familiar with issues affecting large companies, small companies, and GBTC, he appeared to be a “catch” for the organization. The board made the decision to offer Hardebeck the executive director job, hoping to accelerate its new strategic plan, and put someone in place who was more directly acquainted with the Baltimore tech community. Again, this is not a statement against Sharon Webb, it was just an opportunity to move forward with an exceptionally strong candidate. Had the board waited, Hardebeck would likely have moved on to something else.

So, that’s the truth. All of it. Some have accused GBTC of trying to “spin” its PR message, and while it’s true that the group cares deeply about protecting the reputation and feelings of the folks involved in a potentially challenging situation, there has certainly been no effort made to conceal the truth.

Others have even gone so far to say that there are tones of sexism in this action by GBTC, and that GBTC’s board must be dominated by “white males.” This is a particularly daft unfounded line of thinking, as the board is quite large and is made up of a large contingent of brilliant, strong, women and men, including many people of color and diverse backgrounds. While white males are not under-represented, charges of sexism (or any other -ism) are completely unwarranted. Historically this is a board that employed Lewandowski, Gunner, a staff of females, and hired Webb. Enough conspiracy talk.

About Jason Hardebeck

If you’ve not had a chance to meet Jason Hardebeck yet, I encourage you to do so. He’s smart, understands entrepreneurship, and Baltimore Tech. He’s already making changes at GBTC, including blowing up its office in order to put its staff out into the community.

Some people know Jason’s story and background, but others don’t. Some have asked me, “So, he sued Facebook and sold them some patents. Sounds like a patent troll. Can I really look up to that?”

But the full story is complex. As mentioned, he started WhoGlue, one of the very first social networking companies — before LinkedIn or Facebook, back in about 2001. He was probably too early. He pursued alumni association contracts and built a successful business. Around 2003, he acquired a product (and an associated set of patents and a developer) from Siemens, the German communications firm, which would help him to expand his company’s product. He did that and expanded its capabilities, and continued to expand his business. However, due to a variety of factors, his product did not evolve into LinkedIn or Facebook, despite being early to the social networking market.

However, he owned some valuable intellectual property, namely patents for mechanisms for controlling what information people can see about each other in the context of a social network. He put these patents up for auction, and there was considerable interest.

My understanding is at this point he contacted Facebook to inform them that they were in violation of his patent portfolio, and to inquire about a settlement. I believe they responded with a cordial, “So sue us.” (Facebook’s approach to IP has been from the start to settle on an as-needed basis.) So he did. This led to a settlement and acquisition deal, which I suspect Jason can’t say much about himself because of the terms of that arrangement.

So, to dismiss Jason as a mere “patent troll” is to severely misunderstand his background and motivations. He was early to market, made substantial investments in building a business, did so, and then acted to leverage the assets he had built up using the laws afforded by our system. This is totally reasonable, and if you spend some time talking to Jason, you’ll see that he totally “gets” both entrepreneurship and technology. I don’t say this about many folks.

Going Forward

There is a cohesive vision for tech in Baltimore coming together now, between GBTC board members and others in the community. People like me, Jason Hardebeck, Greg Cangialosi, Mike Brenner, Jason Pappas, Tom Loveland, Mike Subelsky, Ann Quinn, Newt Fowler, Ellen Hemmerly, Ann Lansinger, and many others are starting to coalesce around a common set of goals, and agree about what the future can look like. There is more agreement than disagreement.

Tomorrow I’ll start to outline more of that vision. But I’ll leave you with one last thought.

If you don’t feel like your voice is represented in the conversation about Baltimore Tech, speak up. If you don’t think GBTC represents your views, we invite you to ask to join (or present to) the board. GBTC is all of us. There is no wall keeping out certain kinds of voices. It’s all about participation.

I volunteered my voice in 2004. There’s no one stopping you from doing the same today. In fact, it’s more urgent than ever.

P.S. – For what it’s worth, I did not run this post past anyone at GBTC, its chairman (Jason Pappas), or the board. It’s the truth, and I believe the truth is always the best PR.

October 4th, 2010 — business, design, economics, software

Today Twitter CEO Evan Williams announced he would be stepping down as Twitter’s CEO. Dick Costolo, presently the firm’s COO, will take over that role.

As is its custom, Twitter (the site) exploded with the news, as geeks everywhere speculated, double rainbow-like, What does it mean?

The answer is that they’re simply tending to their business. The myth that founders somehow have mythical vision and deserve important sounding titles like CEO is really mostly garbage. Founders are mostly like everyone else, except for one important difference.

Founders try things. They seek new markets and ideas where others don’t. But they seldom have all the answers. Sometimes they are even visionary, but that doesn’t always make a good CEO from a day-to-day build-the-business standpoint.

Fact: Twitter was not Evan Williams’ idea. It was Jack Dorsey’s idea. And in fact Jack was CEO of the company from 2007 til late 2008 when Williams, a co-founder and early funder of Obvious Corp, took over. (Jack, a great guy and a big dreamer, went on to found Square.)

Fact: No one at Twitter had any idea where it might go when it was created. Seriously – neither Dorsey nor Williams predicted this outcome. I’ve talked to them both about it and the fact is they were just regular guys who tried something new. They had enough resources and drive to make sure it could grow, but they really had no idea where it might lead.

The whole idea that folks like Evan Williams, Jack Dorsey, Biz Stone, Mark Zuckerberg, or Kevin Rose are well-suited to actually run the businesses they have created is pretty much a myth. But yet it’s one people seem to like to believe.

Founders have a very different personality from the sort of person required to build, operate, and grow a business financially. The sooner we can all get over the celebrity CEO complex, the better off we’ll all be.

People need to understand exactly what it takes to found a startup, and Eric Ries has gone so far to say that entrepreneurs actively lie to promote the visionary founder myth – and I agree with him.

Costolo is a genius at building a new-media business like Twitter. Williams is a persistent guy who’s willing to break new ground.

Two. Different. People.