Entries Tagged 'design' ↓

November 7th, 2009 — art, baltimore, business, design, geography, philosophy, trends

In 1983 at age 12, I became drawn to the design and tech culture of San Francisco. By that time I was already deeply involved in computers and the other tech of the day, and had been reading every issue of BYTE Magazine cover-to-cover when it arrived in our mailbox after school.

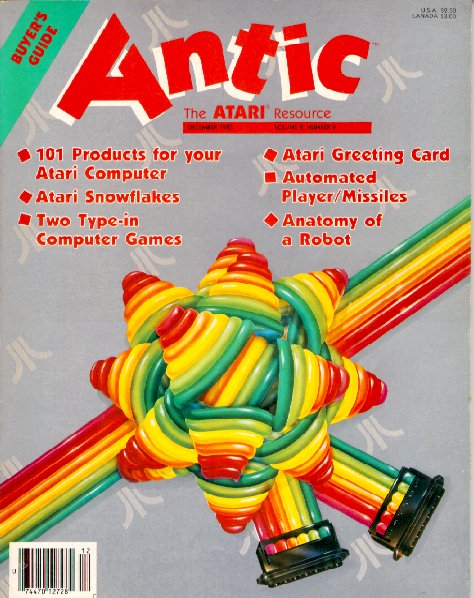

BYTE was produced in New Hampshire and had a scholarly tone; still, the emerging world of computing was breathlessly covered, and offered a sense of endless possibility. But it was Antic magazine (a specialty computing magazine for Atari computers), specifically the December 1983 “Buyer’s Guide” issue that really caught my eye.

The design was colorful and imaginative, with beautiful typography, and the magazine was full of amazing ideas and products which I was sure would launch me on my way to unlimited exploration. I devoured the magazine cover to cover, but I never realized just how much I was soaking up its design ethos. Colorful, playful, and bold, this was not the wry, academic BYTE. It was combining the substance of tech with the emerging design scene in San Francisco, and it resonated with me profoundly.

In 1985, I got a job at a local computer store doing what I loved: selling computers and software and, yes, copies of Antic magazine. In 1986, I started my own computer and software sales company, Toad Computers. In 1989, months after graduating from high school, I had the chance to visit Antic Magazine — this time as an advertiser.

This was my first trip to San Francisco and I visited Antic at their loft office, located at 544 Second Street, right in the heart of the city’s SOMA district. But this was SOMA before it was the SOMA we know now as the home of so many startup tech companies. Beat up and edgy, the open-air second floor office had high-beamed ceilings and gave a sense of history and limitless potential. I was smitten with the city and with valley tech culture – I also visited Atari’s headquarters in Sunnyvale that trip – and absorbed all that I saw.

Later in 1993, I was twenty-one and searching for new things to explore. Toad Computers was doing well but I knew that it would have to change and grow to survive. Atari was having tough times. Antic magazine had folded. To advertise effectively we were sending out massive catalog mailings, featuring 56 page catalogs that I personally designed – very much in the visual style of Antic magazine.

Someone had told me about a new magazine called Wired. I picked up a copy and was immediately struck with its sense of visual design and its aura of infinite possibility through the combination of design and tech. Again, I ingested every word, photo, and illustration in each issue. In early 1994, I noticed an ad that indicated that Wired – this tiny publishing startup – was looking for a circulation manager. I was entranced at the possibility. With my background in direct marketing and managing big catalog mailing lists, I thought this might be an opportunity for me.

In February 1994, I booked a trip to San Francisco to talk to my kindred spirits at Wired about the possibility of working there. I also became entranced with the Internet and its possibilities at this time, and for several days before my trip to San Francisco, I worked feverishly to write an article for Wired about how the Internet – when it became fully developed and evolved – could become a kind of real-time Jungian web of knowledge that acted like a global brain cheap kamagra oral jelly uk. I theorized that the Internet could become a kind of collective consciousness that enabled humanity’s genius to be available to everyone all the time. I predicted online banking, shopping, and video chat and made illustrations to show how these things would work.

Me, with long hair, at Wired HQ in February 1994

Of course, the simple things were not hard to predict at that time, though they were still a few years off. But my central thesis about Jungian synchronicity was just too wacko to print in 1994. And to be fair, I had cobbled the article together in just a couple of days, had worked in ample quotes from Marshall McLuhan and Carl Jung, and had interviewed no one. My thesis may have been strong, but the piece would have benefited from some interviews and editing. But hey, I was inspired and twenty-two.

When I went to Wired’s offices, I was stunned to learn that they were located in the same office that Antic had occupied! The same open air loft office at 544 Second Street. I met with some folks from Wired’s barebones staff. I commented on my perceived sense of Jungian synchronicity — about Antic and Wired sharing the same office space. We talked about job possibilities. I submitted my article.

I didn’t get a job, and they didn’t print my article. To be fair, I wasn’t really ready to move to San Francisco, and I am sure they sensed that. I also wasn’t sure what I wanted. I just knew that I was drawn to this hopeful admixture of design and tech that seemed to emanate, radio-like, from 544 Second St.

In March 2007, two weeks after I had built Twittervision and a week after SXSW launched Twitter onto the early adopter stage, I thought it would be fun to stop by Twitter HQ in San Francisco. I met Biz and Jack and Ev, and was once again amazed to see that something I had been drawn to had come from SOMA; just a few blocks from 544 Second St. And ironically, it is now Twitter and the “Real Time Web” that is beginning to enable the kind of global consciousness that I had predicted in 1994.

This past Thursday at TEDxMidAtlantic (of which I was the lead organizer and curator) in Baltimore, I was struck by the beautiful design of our stage set. (Thanks to Paul Wolman at Feats, Inc. for bringing it together for us!) A simple combination of bookshelves, cut lettering, books, a few objects and blue wash backlighting had combined to produce a gorgeous backdrop for the extraordinary ideas that our speakers would soon be sharing. And I felt at home. I could not go to 544 Second Street and SOMA. Instead, it was my mission to bring it here.

October 26th, 2009 — business, design, economics, philosophy, software, trends

“Disneyland will never be completed. It will continue to grow as long as there is imagination left in the world.” – Walt Disney

Thinking about Eric Ries‘ lean startup methodologies, it occurred to me that Walt Disney pioneered the form in 1955 with the creation of Disneyland. Let’s take a look.

Private Beta: July 17, 1955

Disneyland was officially launched in a private beta in July 1955 to 6,000 guests by invitation only. Unfortunately, those folks shared their invitation links and 22,000 extra guests showed up with forged tickets! Special guests Ronald Reagan and Art Linkletter helped Walt Disney put on a good show that was live-streamed on television.

But the park was anything but a success that first day. Ladies’ heels sunk into the asphalt slurry sidewalks in the hot July sun. A plumbers’ strike meant that only a few water fountains were operational. A gas leak closed several sections of the park.

These setbacks led Disney’s team to refer to this fateful day as Black Sunday. The opening day generated such negative publicity that Disney and his team took special care to invite the press back the next day and in the coming days to see “the real Disneyland” and see things as they had been intended.

But even if things had gone as planned, only 18 attractions were operational those first few days. Tomorrowland had just four attractions and was admittedly incomplete. Several other attractions would open later in 1955 and 1956.

When Disneyland opened in July 1955, it was literally the minimum viable product. With just $5 Million in financing, there was a lot that Walt wanted to put into the park, but there was only so much money and time.

They launched with what they had ready and took the hit for the stuff that was broken. Why? So they could learn from their customers.

Customer Development

Disney listened to his customers. This change log on the site Yesterland.com shows how much stuff opened in 1955 was eliminated or modified over the years.

New rides were added, old ones modified; others became simply obsolete or required updates. The awkward and failure-prone Flying Saucers ride was replaced in 1967 with the Tomorrowland Stage, which was in turn replaced in 1986 with the Magic Eye Theater. The “Rocket to the Moon” became the “Rocket to Mars.” The iconic Matterhorn Bobsleds ride didn’t open until June 1959, nearly four years after the park’s debut!

Disney’s guest relations department has had the benefit of hearing a huge volume of customer feedback – about which attractions people enjoy, which ones they hate, and which ones literally make them sick. With such a powerful mechanism for continually collecting feedback from millions of customers (who take pride in interacting with one of the world’s most prestigious brands), the Disney organization has benefited from a feedback cycle of continuous improvement.

If Disney and his team had gone into “stealth mode” for 55 years, could they ever have produced the park that we see today?

Build On One Success

After Disneyland was successful, and could benefit from a methodology of continuous improvement, they were able to obtain the financing necessary to build Disney World, Epcot, Euro Disneyland, Animal Kingdom, Disney’s California Adventure, and several other projects. You might think of each of these as several products in a portfolio, but they all flowed from the fundamental success of the original and the conviction that it was okay to launch with a halfway-there product in July 1955. They knew that customers would help them find the way forward.

Disneyland has always been the result of the interaction of management and customers to produce an experience that is valuable for its customers and profitable to operate.

Your software business should take the same approach. You don’t know what your customers are going to want. Launch with something workable, even if flawed. Then iterate with continuous improvements after that. Then, you and your customers will be building something valuable together.

Your product should never be completed, as long as there is imagination left in the world!

October 24th, 2009 — art, business, design, economics, philosophy, software, trends

One of the disturbing things we notice as children is that paper money has no inherent value. Why is it that green pieces of paper are accepted in exchange for all manner of goods and services? Because we have all agreed that it should be so.

Mostly, it is because the various sovereign governments whose soil we inhabit have stated that they will accept payment of tax only in these currencies. So we had best have some of it. This demand creates motivation for all of us to work to get at least a minimum amount of it, and many of us would like to have more than a little.

So, we accept this “green lie” as a fact of life. Money makes the world go around, and we’re all playing this game under penalty of deprivation, or incarceration at the worst case.

Waking Up

Just like Neo, we are called to “wake up” and recognize the nature of this system. Socialist-capitalist world governments are a reality that we impose on ourselves; if we can look up and see beyond it, a whole new world opens up.

Currency Is Different from “Money”

Currency, the worthless bits of paper and metal we trade for handy things like food, beer, and fuel works pretty well and we can rest reasonably sure in our ability to use it to survive.

But what about your 401(k)? It’s an illusion. The financial system is engineered to compel you to shuffle the majority of your wealth into ledger accounts that exist only in your mind. And these “account balances” cause you to make all kinds of decisions — whether to eat out tonight, whether to buy a car or a house, whether to overthrow the government — in particular ways. Your behavior is, in a very real way, controlled by how much “money wealth” you perceive you have.

Glitches In The Matrix

When global financial bubbles jitter as they have done in the last 18 months, home values and 401(k) balances can be badly hurt. These downturns in perceived fortune, in a very real way, cause people to modify their behavior. Maybe you won’t eat out, maybe you won’t take that trip, maybe you won’t start a business. Why do you change your behavior when none of this is real?

Political Implications

Historically, governments are overthrown when unemployment reaches a sustained 15-20%. Current Keynesian fiscal policy adopted by the Fed is aimed at having a variety of control mechanisms to stimulate the economy (lower interest rates; bank lending; TARP mechanisms) when unemployment gets out of control.

But, as we have seen, these market interventions usually lead to unintended consequences. It’s been widely stated that the bank and insurance bailouts were “gifts” to firms like Goldman Sachs who disproportionately benefited from “loopholes” in the regulatory climate. You and your children will certainly pay for these mistakes in the form of devalued currency and sustained taxation.

My point here is to emphasize that monetary policy is an instrument of the state which is used to keep the populace in-line. The debates between the left and right over tax policy are pointless when fiat money allows the Federal Reserve to tweak the knobs of reality at will. And as long as you are motivated by money, you are under the control of this system — and the debates of left and right are just distractions to keep the masses busy. Bush? Obama? Who cares. It probably doesn’t matter to your bottom line. If it doesn’t matter to your personal security, why worry about it?

Finding Inherent Value

Do you ever wish you had a real skill? I don’t mean manipulating ideas or paper, but something tangible? Doctors can trade their services for food. Builders could trade their services for future return of garden produce.

What if your 401(k) was simply gone tomorrow? I don’t mean badly eroded, but gone. What would your future look like? What would be left for you if the monetary system — and all of our current economic system — went bust? What would you have left?

I’d argue you have more than you might imagine. You have family, friends, some basic skills, and an ability to trade effort for necessities. Because everyone would be in the same boat, this would be easier than you might imagine (though it would certainly be chaos).

Current social network tools allow you to start building an economy in the form of interpersonal relationships; by sorting people by shared interests and shared inherent motivations, these tools allow people who find meaning in the same things to find each other. And meaning is at the heart of interpersonal exchange.

Do Important Things

If you endeavor to do things that matter — things that help others, things that change the world, things that have meaning — you will accrue amazing awards in interpersonal relationships. People respect leaders. People respect those who make sacrifices for others. If you’re only in it for yourself and your ability to extract imaginary cash from the system, where will you be when the system fails?

“The System’s Gonna Fail”

In the 1972 film Deliverance, Lewis Medlock (Burt Reynolds) makes a case that “the system’s gonna fail.”

Burt Reynolds: “Machines are gonna fail, and the system’s gonna fail… then…”

Jon Voight: “And then what.”

Reynolds: “Then, survival — who has the ability to survive. That’s the game… survival.”

Voight: “And you can’t wait for it to happen, can ya? You can’t wait for it… Well, the system’s done all right by me.”

Reynolds: “Oh, yeah… You got a nice job, got a nice house, a nice wife, a nice kid.”

Voight: “You make that sound rather shitty, Lewis.”

He may be slightly exaggerating the situation, but when you read books like Extraordinary Popular Delusions and the Madness of Crowds (Charles Mackay, 1842 – yes, 1842!) you start to realize that the financial system we have now is only different from those in the past in that we don’t yet know how this one will fail.

That’s right: we just don’t know how this ends, but it will most assuredly end.

Cash as a Symptom of Good Work

If you spend your days creating real change, the distribution platform for your ideas and your work is larger and less expensive than ever before. Do something original and the entire world is your audience. Do something great and the world will want to reward you.

You can accrue massive “whuffie” in interpersonal relationships, but you’ll also very likely accrue a lot of cash if you do work that is both original and inherently valuable.

And since there’s no way of knowing when the system’s gonna fail, it’s best to simply do good work and build strong relationships. Then you’re covered no matter what happens.

You can only master the matrix when you stop playing by its rules. Wake up, Neo.

October 24th, 2009 — business, design, economics, social media, software, trends

Technology investment bubbles have given many entrepreneurs the impression that success in tech is all about coming up with a “cool idea,” pitching it to a VC, getting funding, building up the business, and then exiting in high style.

First, this is a fairy tale, second, this will not happen to you, and third, what you’re observing is the product of a highly evolved network of peers, of which you are likely not a part.

What Happens in Palo Alto Stays in Palo Alto

What you see taking place in Silicon Valley is the result not of people betting on “cool ideas,” but of people betting on teams and connections. Before every VC deal, there is an exit strategy in mind. Every VC-backed valley startup is an outsourced R&D play.

Ever notice that many large tech firms grow primarily by acquisition? Most have comparatively lean R&D operations; this keeps experimenting off of their balance sheet, thus improving profits and lifting stock prices. Those stock prices are what give them the fuel to make good sized acquisitions, which in turn is the incentive for startups to grow and for VC’s to fund them.

This is the capitalist cycle in its most fully evolved form. Sometimes those acquisitions work out, sometimes they don’t, but the process feeds the machine and it becomes self-perpetuating. This process is literally the grist for the innovation mill that is Silicon Valley.

Why You Should Forget About VC’s — For Now

If you’re not already plugged into this world (meaning you have a lot of contacts there and have a specific idea of a strategy to get funding and an exit before you start), you probably have no place talking about VC’s at all. So ban it from your vocabulary. They’re not interested in you and won’t be. Yet.

Instead, think about how you’re going to build value outside of that network. It is totally possible, but don’t get distracted thinking about VC’s when you should be thinking about bootstrapping and investment from friends, family, and angels.

The good news? Most software startups can be launched for $50K or less these days. Build the minimum viable product, ship it, and then follow lean startup methodologies to iterate towards something that is valuable to the market. Once you have done that, established a revenue stream and can demonstrate some reason why venture capital investment will help you grow fast and capture a market position that you couldn’t capture otherwise, you may be ready to talk to a venture capitalist.

But more likely, investors will come to talk to you! If your startup shows real promise, VC’s will likely seek you out. If you work with some angel investors, they will likely have networks that can help you secure a next round of investment. It will happen naturally. Stop thinking about VC’s. They will find you. Worry instead about building value.

Think Investors, Not VC’s

Yesterday I wrote a post that suggested that entrepreneurs should always think like investors, and always consider what an investor would think of the company. I stand by this, but I am absolutely not talking about VC’s in the early stage. You are not ready for VC’s in the early stage, especially if you are not “plugged in” to the valley culture.

So, think like an investor. Your investors are: you, your family, angels, and possibly local government business development funds. Forget about VC’s for now. If you build value for your yourself, your customers, and your first round of investors, VC’s will come knocking if they think they can help.